Stock trading bots powered by AI have fundamentally altered the competitive landscape of the financial services industry by using state-of-the-art algorithms and machine learning methods. The best ten available AI will be discussed in this article. These trading bots might be useful for traders who do tasks in the financial market that need varying degrees of expertise.

10 Best AI Stock Trading Bots 2023

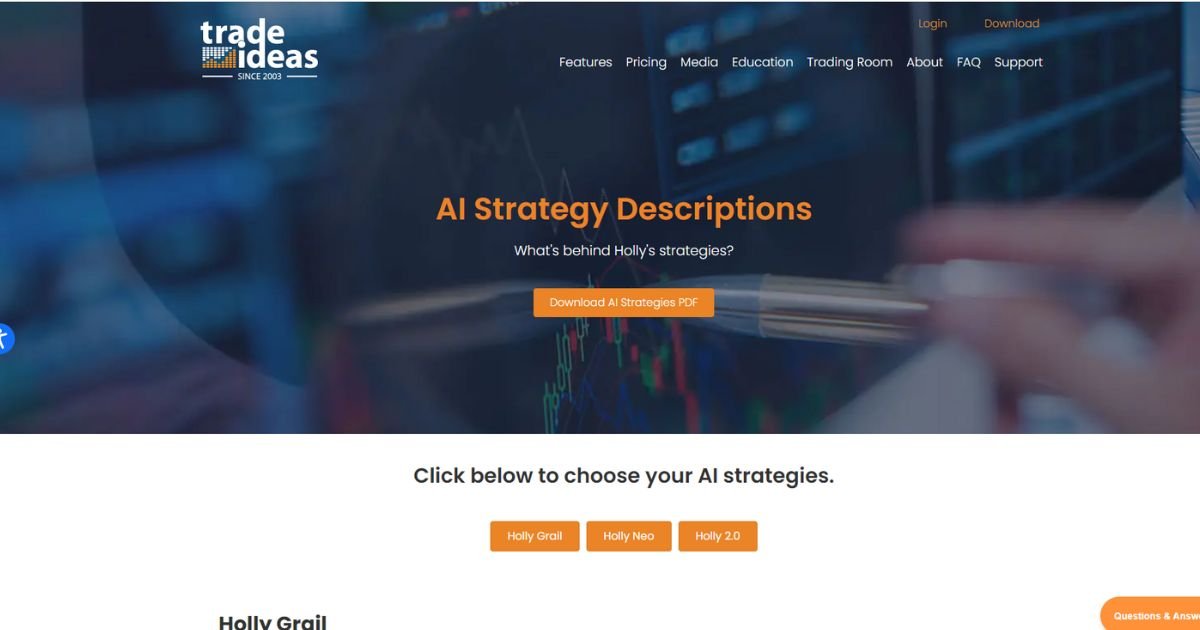

1. Trade Idea

Key features of Trade Idea

- Trade Ideas analyzes market data in real-time using AI-enhanced trading tools. Based on the user’s historical actions, these algorithms provide statistically weighted recommendations for when the user should join and exit a trade, allowing them to refine their trading techniques.

- Trade Ideas was developed to accommodate vendors with varying expertise. Participating in virtual training and practice events might be useful for new buyers entering the financial trading industry for the first time.

What I Like

The team of entrepreneurs and industry professionals that created the trading platform Trade Ideas uses specializes in financial technology.

What I Dislike

Trade Ideas’ premium features are only accessible to those who pay the program’s enrollment fee.

Price

Try Trade Idea

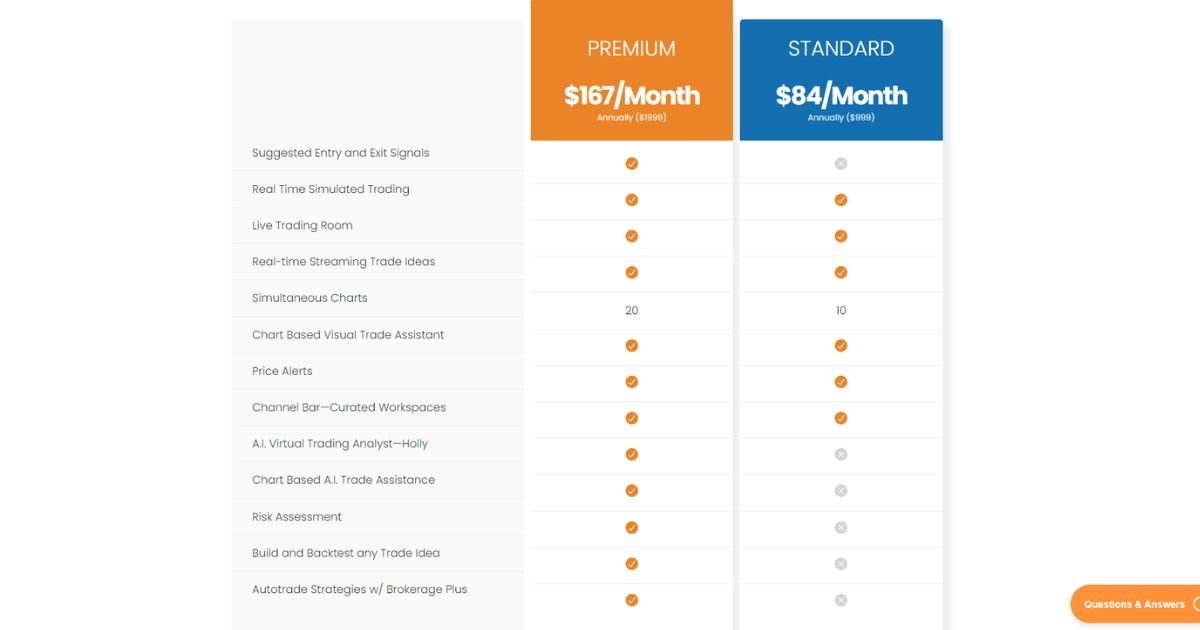

2. SignalStack

Key Features of SignalStack

- Users of SignalStack may automate trade orders and save time by converting signals from any trading platform into actions in their exchange accounts. To act swiftly and take advantage of market opportunities, traders no longer have to put bids manually.

- SignalStack allows you to process data from any machine in the globe. This provides consumers with several viable alternatives.

What I Like

SignalStack claims it levels the playing field by enabling small investors to automate order placing on par with large institutions like hedge funds.

What I Dislike

While SignalStack’s automated functions are convenient, the software cannot be modified to accommodate other trading strategies.

Price

Try SignalStack

3. Stock Hero

Key Features of Stock Hero

- Stock Hero’s “paper market” allows users to practice trading in a simulated environment. Traders may hone their abilities without worrying about the consequences of making a mistake because of the system’s ability to replicate all conceivable outcomes.

- Stock Hero facilitates a smooth transition from the virtual to the actual market, allowing users to put their newly honed trading skills to the test immediately.

What I like

Using the Stock Hero paper trading tool, investors may assess the viability of their trading strategy.

What I Dislike

The Stock Hero paper exchange game provides players with a realistic market representation, but it may need further refinement before it can be considered seriously genuine.

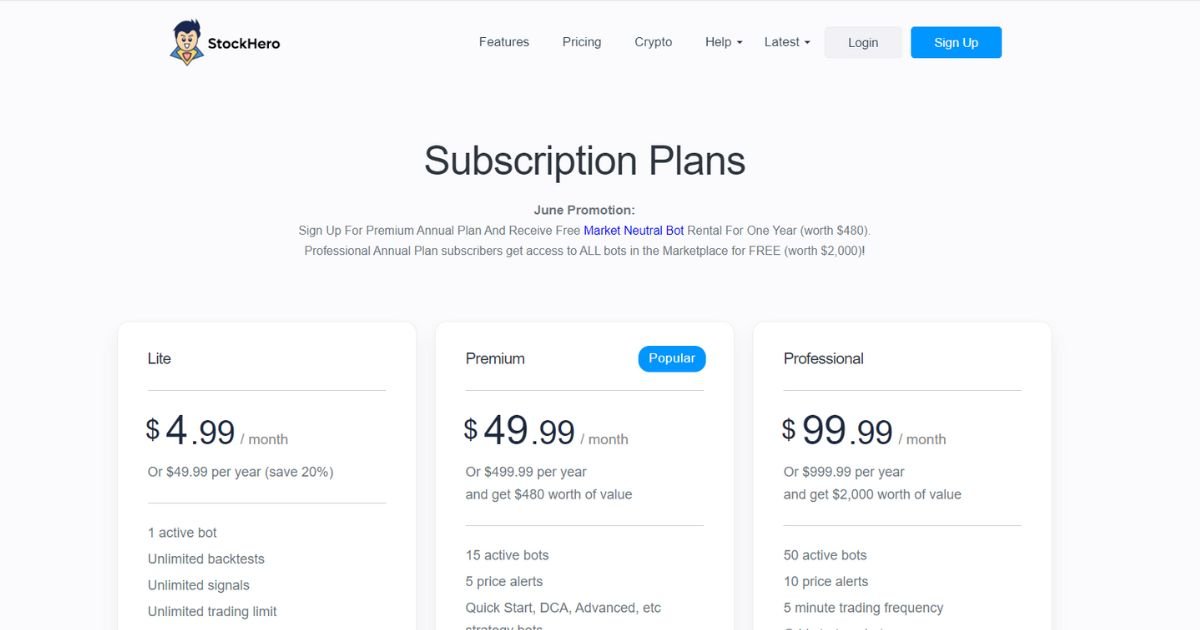

Price

Try Stock Hero

4. Tickeron

Key Features of Tickeron

- Tickeron’s AI Robots feature displays recent trades and predictions of future outcomes in real time. This tool also has a “stop loss” threshold and “profit/loss” indicator levels. This is made feasible because customers can see their actions and the results they produce in real-time.

- Tickeron is operated by AI robots that generate a trading options list that adapts in real-time to the state of the market.

What I like

Trading options provided by Tickeron are at the forefront of AI development and include real-time transaction monitoring, neural network-powered automated trading rooms, and AI-predicted market trends.

What I Dislike

The platform only reveals a subset of the algorithms and techniques used by its AI systems. This is because such details are confidential.

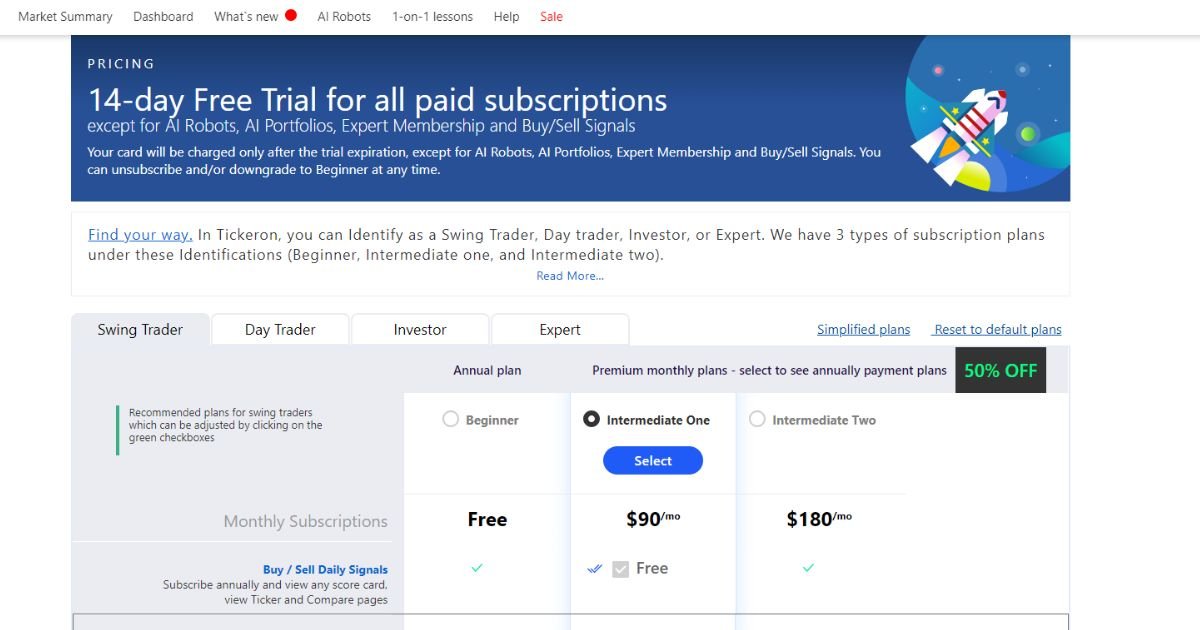

Price

TrY TickerOn

5. Equbot

Key Features of Equbot

- To gather data about ETFs, Equbot use artificial intelligence (AI). Because of this, the organization may advise its customers on how to protect themselves from any potential dangers best.

- To keep its users up-to-date on the newest financial developments, Equbot arbitrarily assesses news pieces from various sources located all over the globe.

What I like

Equbot pulls information from ETFs and AI to provide comprehensive insights and advice to its consumers.

What I Dislike

Equbot’s proprietary AI development processes are currently unavailable to the general public.

Try Equbot

6. Imperative Execution

Key Features of Execution

- Imperative Execution’s Intelligent Cross-platform employs AI to optimize business operations. It will do this by quickly and precisely matching orders in response to incoming requests.

- Users using Imperative Execution additionally have access to ASPEN, an additional powerful resource.

Wht I Like

Imperative Execution places a premium on eliminating market effect, which offers many unexpected advantages.

What I dislike

Nonetheless, Imperative Execution is largely regarded as a significant informational resource in the USA. It was probable that its offerings would only apply to equities and fixed-income securities.

Try Imperative Execution

7. Algoriz

Key Features of Algoriz

- Traders of both bitcoin and equities may utilize Algoriz to develop, backtest, and optimize their trading strategies.

- Quickly and securely access your trading account anytime you choose with Algoriz. Using this software, your organization may more easily create automated trading algorithms.

What I like

For those who need to become more familiar with programming, Algoriz’s user interface is straightforward.

What I dislike

Algeria relies on data from impartial third-party sources when developing and evaluating algorithms.

Price

Try Algoriz

8. Kavout

Key features of Kavout

- Kavout uses an AI engine named “Kai” to sift through data such as stock prices, news articles, blog postings, and social media feeds. Kavout’s mission is to improve people’s understanding of business, and he plans to do it using AI technology.

- Kavout provides its users with paper trading stock to practice investing without risking their money.

What I like

Customers of Kavout have access to a suite of analytical tools, including stock screening and performance monitoring.

What I Dislike

The effectiveness of the company’s Kavout service, which powers the platform, hinges on the dependability of the AI applications it employs.

Try Kavout

9. Scanz

Key Features of Scanz

- Scanz’s clients may do a comprehensive stock market analysis in a flash.

- The News Scanner provides Scanz clients instantaneous access to news from over a hundred sources, including press releases, financial blogs, and SEC filings. You may read about the latest events in the press, on financial blogs, or in SEC documents.

What I Like

Swing traders and day traders will benefit the most from Scanz’s comprehensive market monitoring.

What I dislike

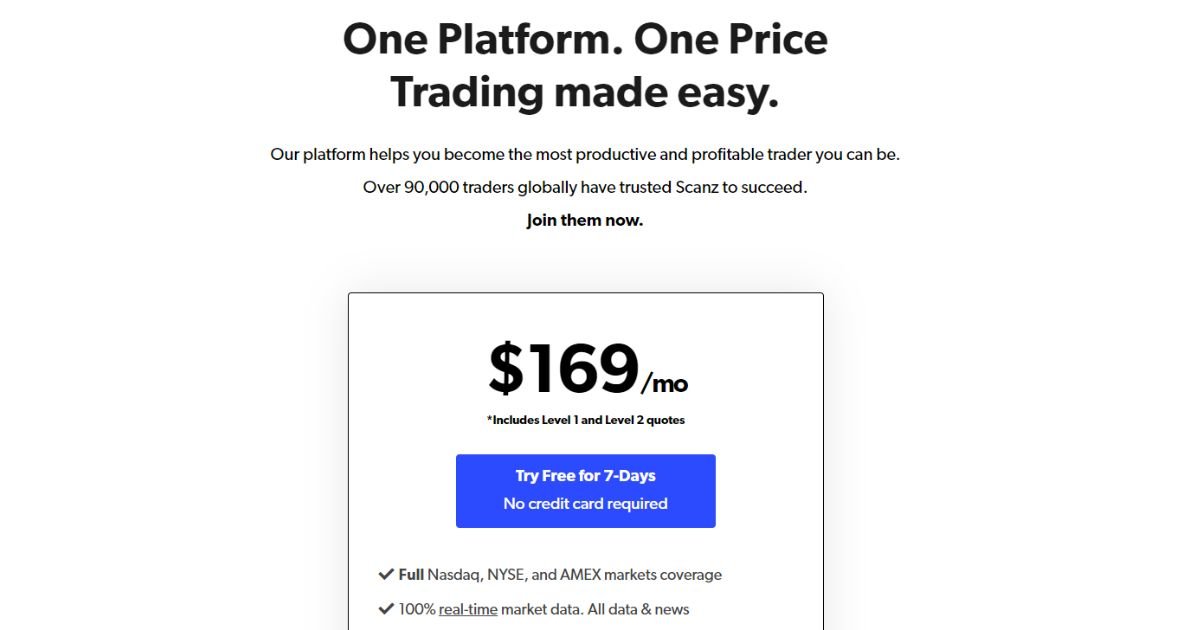

Some customers may ponder Scanz’s price tag before making a purchase.

Price

Try Scanz

10. TrendSpider

Key features of TrendSpider

- Thanks to specialized machine learning software, TrendSpider can do complex technical analyses.

- Users can practice and refine their trading methods on the platform’s Strategy Tester before deploying them on the site as fully automated bots.

What I Like

Traders may automate routine operations and trade based on predetermined criteria using the Trading Bots functionality.

What I dislike

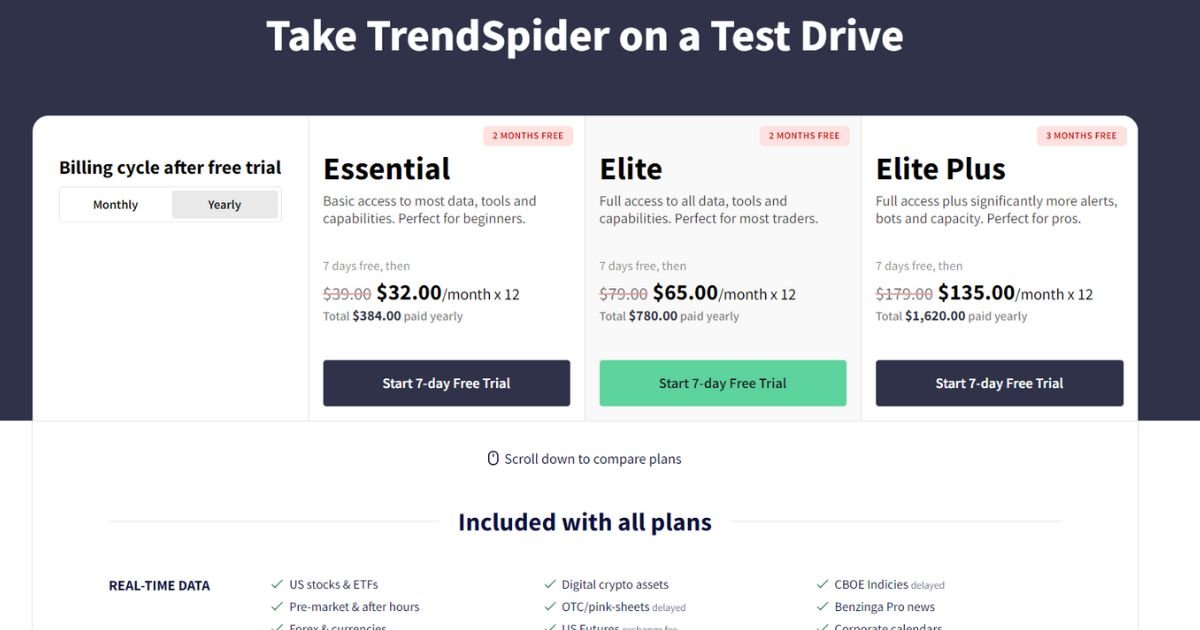

It may take some time for first-time TrendSpider users to get comfortable with the software’s extensive fundamental analysis and trading bot functions.

Price

Try TrendSpider

Conclusion

The AI stock trading bots discussed here illustrate how algorithms driven by automation and artificial intelligence alter the global financial system. Traders and buyers can see into the future with the help of this cutting-edge technology, which shows that business will only become more lucrative and successful.